–>

4th Quarter Real Estate

HOME IMPROVEMENT ADVICE

___________________________________________________________________________________

Does Your Home Have An Odor?

MORTGAGE ADVICE

___________________________________________________________________________________

Your Rights As a Borrower

- Receive equal treatment by the lender, so that a credit decision isn’t based on your race, color, religion, national origin, sex, marital status, age, or whether any of your income is from public assistance.

- Shop for the best loan type for you, whether adjustable or fixed rate, and compare the fees of different lenders.

- Be informed about the total cost of your loan including the annual percentage rate (APR), points and other fees. Your interest rate is based on your credit history and credit scores, the borrowed amount and how much you’re putting as a down payment.

- Receive a Loan Estimate and Closing Disclosure Form, formerly known as a Good Faith Estimate, before you agree to the loan and pay any fees. Compare the exact loan product you want as offered by two or more lenders.

- Know which fees are not refundable if you decide to cancel the loan agreement, such as the fee to research your credit.

- Ask questions about loan terms and fees that you don’t understand.

- Know the reason if your loan was turned down.

- Buy wisely. Buy as much home as you can without straining your resources, so you can occupy your home longer. Moving and closing costs eat away equity.

- Pay a little extra. Pay a little more every month toward reducing your principal. Use bonuses or cash back on your credit cards to apply to your mortgage. Making one extra payment a year could shorten your loan payoff by as much as four years, saving you thousands of dollars in interest.

- Pay off other debts. Don’t incur new debt. Spend less on automobiles, dinners out and other expenses. Pay off credit cards and student loans as quickly as you can, so you’ll have more money available to pay toward your mortgage.

- Make improvements. Keeping your home repaired and updated helps you preserve equity by making market value higher.

- Let time work for you. Think of your home as a savings account where the money you put in can be retrieved one day – with interest. Historically, homes have increased in value as much as three percent a year in normal markets, which is a great way to build instant equity.

Moving made EASY!

Get organized early

Avoid leaving anything until the last minute. Unless you have to pack up and leave in a hurry, chances are you have between 30 and 60 days to make a plan and ensure that moving day runs smoothly. Create a countdown list and itemize everything you need to accomplish week by week.

Figure out your move strategy

How are you going to get from point A to point B on moving day? For shorter moves, you’ll either need to assemble some very nice friends with trucks or consider renting a truck for the day. If you have a big family to move or you’ll be moving a long distance, you’ll want to price out moving companies.

Keep your movers in the loop

Boxes are one thing, but when you get to the big, heavy stuff, it’s important to let your movers know what to expect. “Communicate with your moving company and explain all the requirements and expectations prior to booking,” advises Andrew Ludzeneks, founder and current president of iMove Canada Ltd. “Your mover has to be aware of all those minor details in order to estimate your total move time and cost, and have proper equipment available.” That includes informing the company about any overweight items (i.e. a piano or fridge), access restrictions (small elevator, walk-up only, narrow driveway) and whether you’ll need help with disassembly or assembly of furniture.

Pick the right transportation

If you’re moving a short distance, you may be able to get away with making more than one trip. But if you don’t have that luxury, you’ll need to make sure you have the right size of truck to cart your belongings in one go. Choosing the right size is particularly important when moving farther away, as making several trips could be a problem, we recommend using the following guidelines when determining the size of your truck:

• In general, the contents of bachelor and one-bedroom apartments will fit in a 16′ cube truck available at your local rental company.

• Two to three fully furnished bedrooms will require a 24′-26′ truck to ensure your move is completed in one load.

• The contents of most houses can be moved in the same 24′ truck with one or two trips.

Seize the opportunity to purge

Moving is a great chance to organize your belongings and get rid of items you no longer use. If the time of year permits, hold a yard sale. Or, take the time to sort and donate gently worn clothing to Goodwill, put furniture up for sale on a site like craigslist.org, recycle old magazines and catalogues and shred old documents.

Put together a packing kit

If more than one person is packing, stay organized by establishing a system. Have blank inventory sheets prepared so one person can tackle each area or room. Arm each packer with a pen, black marker, and packing materials, like newspaper, a packing tape dispenser and boxes.

Green your move

Moving day can generate a great deal of waste like cardboard, bubble wrap and newspaper. For items you’ll be storing even once you’ve moved in, opt for the reusable plastic bins you can purchase at stores like Home Depot or Solutions. These can be labeled to go directly into closets until you’re ready to deal with the contents. You can avoid cardboard for the rest of your belongings, too, by renting plastic bins from a company like Blue Bins Unlimited. You might also consider using older linens to wrap breakables.

Reuse boxes

You may still need a few cardboard boxes to round out your moving kit. A few weeks before you start packing, grab a few each time you visit the grocery store. Keep in mind that smaller boxes are easier to carry when facing stairs and narrow pathways.

Take inventory

This is especially necessary if you’re hiring a moving company. Having a record of your household items is useful if something goes missing, maybe even consider a video of your belongings. Consider keeping a spreadsheet of the contents of each box. Then, assign each box a number and all you have to do is write that number on each side (maybe with the appropriate room listed, as well).

Label everything!

Label all sides of the box (avoid the top). Whoever is carrying in your boxes might not make sure all labels are facing one way for your easy retrieval. Try labeling each side in marker so you can easily find what you need in a stack.

Find out your condo rules

Moving into a condo isn’t as easy as pulling up to the front door and loading your boxes onto an elevator. Be sure to check the moving policy before scheduling your moving day. For example, some condos don’t allow move-ins on Sunday. You may need to book a service elevator and a time frame for moving in. On most occasions, your condo will ask for a security deposit in order to book a service elevator. That can range from $100 to $500 depending on your condo rules.

Pack in things you need to pack

You need to take your luggage with you. Why not use it as a box? The same goes for dresser drawers. You may need to remove them for transport, but if you don’t have too far to go, they can be helpful for light items. “For delicate apparel that you don’t want to fold, using a portable wardrobe box is the way to go,” recommends Andrew.

Prepare a moving day kit

Keep one box aside of “essentials” that you’ll need on moving day: cleaning supplies, light bulbs, toilet paper, garbage bags, a change of clothes, your toiletry bag, etc.

Be ready for your movers, whether hired or friends

Whether you have family or professional movers showing up at your door, be ready for them when they arrive. With a moving company, unless you hire packers, be ready and packed before the crew arrives. “Scrambling for boxes will delay your move and increase your cost.”

Protect your valuables

Find a safe place to store your valuables on moving day. Insure anything that’s valuable or breakable if you’re using a moving company. And if you’re moving a computer, do a quick backup of important files just in case something happens in transit.

Delay deliveries

If you’ve made some new purchases, such as a couch or dining room suite, schedule the delivery after moving day. That will help you focus your attention on moving day itself and will avoid any congestion between delivery people and the movers.

Don’t mistake belongings for trash

Try to avoid packing things in garbage bags. Well-meaning friends or family could accidentally throw them out on moving day.

Hook up essential services

Make sure you understand how utility bills (gas, water, electricity) will be transferred over to you from a previous owner. Also, arrange to have your phone line, cable and Internet working if necessary.

Find a pet sitter for the day

If you have a pet that could be traumatized by a move, arrange to have them stay somewhere during moving day. If you’re hiring movers for a long-distance move, be sure to arrange your pet’s safe transport to your new home.

Make nice with your new neighbours

Start off on the right foot by informing your immediate neighbours that you’ll be moving in and what kind of moving vehicles you’re using. If you’re moving on a weekday, make sure your truck isn’t blocking anyone’s exit. If it’s wintertime, clear your driveway of snow and ice. “Make sure there’s plenty of room to park the moving truck. That’s essential on busy streets otherwise you could slow down your move … increasing your total cost.”

Treat your movers

Whether hired movers or friends and family, be sure to have food and drinks readily available for everyone. On a hot summer day, your crew will appreciate a cold drink.

STEADY MARKET PREVAILS

2nd Quarter 2018 | REAL ESTATE REPORT

STEADY MARKET PREVAILS

12 Month Rolling: May 2017 – June 2018 ($ has been rounded to nearest 500 or 1,000)

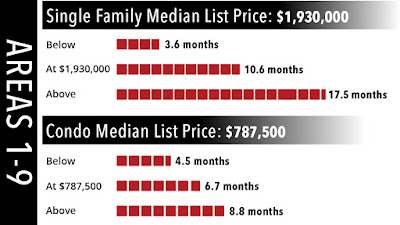

RELATIVE TO MEDIAN PRICING

Year-over-year, the number of single-family home sales within the City Limits was up 9%, while the median price of $1.93 M remained flat to last year. By neighborhood, Old Town had the highest number of sales – up 36%, while there were 20% fewer sales in Park Meadows.

Sales in the Heber Valley continued at a strong pace, with nearly one sale a day, and a 28% median price increase to $506,000. There were 20 more homes sold in Red Ledges compared to last year, with a median sales price of $1.16 M – up 8%. Midway continued to thrive with 96 closed sales and 17% median price increase reaching $544,000.

In the Kamas Valley, the number of sales decreased 15%, though the median price climbed 10% to $412,000. Sales numbers in the Wanship, Hoytsville, Coalville, Echo, & Henefer areas remained the same with a median price of $359,000.

Year over year, the number of condominium sales within the City Limits was up 8% and up 15% in median price to $787,000.

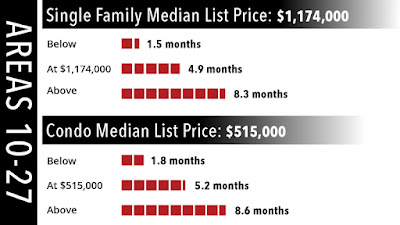

The Snyderville Basin reported essentially the same number sales as last year with 308 units and median price of $503,000. The Kimball Junction area saw flat sales but a 15% median price increase to $385,500.

The number of closed sales dropped 20% in the Jordanelle area, likely due to lack of inventory as new construction inventory has been absorbed, but there was a 12% increase in median price reaching $528,000.

FREE HOME EVALUATION….$495 VALUE

–>

FREE HOME EVALUATION….$495 VALUE

–>

27 THINGS YOU SHOULD KNOW

1. UNDERSTAND YOUR REASONS FOR SELLING

Your motivation to sell is the determining factor as to how we will approach the process. It affects everything from what you set your asking price at to how much time, money, and effort you are willing to invest in order to prepare your home for sale. For example, your approach would be different if your goal was to make a quick sale. However, if you want to maximize your profit, the sales process might take longer and, consequently, you would want to take a different approach.

2. KEEP THOSE REASONS FOR SELLING TO YOURSELF

The reasons you are selling your home will affect the way you negotiate the sale. By keeping this to yourself, you don’t provide prospective buyers with leverage they may be able to use. If, for example, they should learn that you must move quickly, you could be placed at a disadvantage in the negotiation process. When asked, simply say that your housing needs have changed. Remember, the reason you are selling is only for you to know.

3. DO YOUR HOMEWORK BEFORE SETTING A PRICE

When you set your price, you make buyers aware of the absolute maximum they have to pay for your home. As a seller, you will want to get a selling price as close to the list price as possible. If you start out by pricing too high, you run the risk of not being taken seriously by buyers and their agents. On the other hand, pricing too low can result in selling your home for much less than you were hoping for. Here are a few tips for setting your home’s sale price:

If you live in a subdivision where most of the homes have similar or identical floor plans and were built in the same period, simply look at recent sales in your neighborhood. This will give you a good idea of what your home is worth.

If you live in an older neighborhood where the homes unique and built in different time periods, you may want to seek out a real estate agent to help you with the pricing process. As neighborhoods grow, property values will change based on the new homes being built and the age of older homes in the area, and it can be hard to find truly comparable homes to compare pricing with.

If you decide to sell on your own, look at homes that have sold in your neighborhood within the past six months and homes that are currently on the market. Prospective buyers will assess the value of your home by comparing it with homes in your area, so doing that comparison on your own can help you establish your home’s value. You might also consider a quick trip to the City Hall, where you can search the public records for information about home sales in most areas.

4. DO SOME HOME SHOPPING FOR YOURSELF

The best way to learn about your buyers is to check out other open houses. Take note of floor plan, condition, appearance, size of lot, location, and other features. Especially take note of the initial asking price and, if you keep tabs on the property, the final selling price. Remember: if you are serious about selling your home fast, don’t price it higher than your neighbors.

5. THE PROS AND CONS OF GETTING AN APPRAISAL

Sometimes a good appraisal can be a huge benefit in the marketing process. Getting your home appraised is a great way to let prospective buyers know that your home can be financed. However, an appraisal does cost money, has a limited lifespan, and there’s no guarantee you’ll like the figure you receive.

6. WHAT TAX ASSESSMENTS REALLY MEAN

Some people think that tax assessments are a way of evaluating a home. However, the difficulty is that assessments are based on a number of criteria that may or may not be directly related to property values, and so they may not necessarily reflect the true value of your home.

7. HELPING YOU TO DECIDE ON A REALTOR®

According to the National Association of REALTORS®, nearly two-thirds of people who sold their homes themselves say they wouldn’t do it again. Primary reasons included having to set the price, marketing handicaps, liability concerns, and time constraints. When deciding on a realtor, consider at least two or three candidates. Be wary of quotes that are too low as well as those that are too high.

All realtors are not created equal. A professional real estate agent knows the market, has information about past sales and current listings, can show you a comprehensive marketing plan, and will provide their background and references upon request. Evaluate each candidate carefully, on the basis of his or her experience, qualifications, enthusiasm, and personality. Be sure you choose someone that you trust!

If you choose to sell on your own, you can still talk to an agent. Many are more than willing to help people with paperwork and contracts, and should anything go wrong, you will have someone you can call for help.

8. BE SURE YOU HAVE ROOM TO NEGOTIATE

Before setting on your asking price, make sure you leave yourself room with which to negotiate. For example, set the lowest price at which you are willing to sell your home along with your ideal selling price. Then think about your priorities and figure out if you want to set the price closer to the high end, in order to maximize your profit, or closer to the low end, if you want or need to move quickly.

9. APPEARANCES MATTER!

Appearances are critical to the selling process, but many sellers are unaware of this. If its onto compelling its not selling. The look and feel of your home has an enormous impact on a prospective buyer’s emotional response to your home—they will react to what they see, hear, feel, and smell and their decision will be affected by those things just as much as the selling price.

10. INVITE THE HONEST OPINIONS OF OTHERS

The biggest mistake you can make at this point is to rely solely on your own judgement. Don’t be shy about seeking the honest opinions of others as your try to sell your home. You need to be objective about your home’s good points as well as its bad ones. A professional real estate agent is a great resource for this, as they have the ability to be objective and forthright about what needs to be done to make your home more marketable.

11. CLEAN AND FIX EVERYTHING

Scrub, scour, tidy up, straighten, clean the clutter and declare war on dust. Repair every squeak, broken light switch, and tiny crack in the bathroom mirror because even these small things can be deal-killers… you’ll never know what can turn buyers off. Remember you’re not just competing with other resale homes, but brand new homes as well.

12. LET BUYERS VISUALIZE THEMSELVES IN YOUR HOME

The last thing you want prospective buyers to feel when viewing your home is that they may be intruding into someone else’s life. Avoid clutter such as too many knickknacks, etc. If possible, decorate in neutral colors, like white or beige and place a few carefully chosen items to add warmth and character. You can enhance the attractiveness of your home with a well-placed vase of flowers or potpourri in the bathroom. Home décor magazines are great for tips and ideas.

13. DEAL-KILLER – ODORS MUST GO!

You may not realize it but odd smells like traces of food, pets, and smoking odors can kill deals quickly. If prospective buyers know that you have a dog, or that you smoke, they’ll start smelling odors and seeing stains that don’t even exist, so get rid of all the clues.

14. DISCLOSE ALL THE DEFECTS

Smart sellers are proactive in disclosing all known defects to their buyers in writing. This can reduce liability and prevent lawsuits later.

15. THE MORE PROSPECTIVE BUYERS, THE BETTER

When you maximize your home’s marketability, you will most likely attract more than one prospective buyer. It is much better to have several buyers because they will compete with each other; a single buyer will compete with you.

16. KEEP YOUR EMOTIONS IN CHECK

Let go of the emotions you’ve invested in your home. Be detached, using a business-like manner in your negotiations. You’ll definitely have an advantage over those getting caught up emotionally in the situation.

17. LEARN WHY THE BUYER IS MOTIVATED

The more you know about a prospective buyer, the better equipped you are to use the negotiation process to your advantage; controlling the pace and duration of the process. As a rule, buyers are looking for the best possible property for the least amount of money, and knowing what is motivating their purchase enables you to negotiate more effectively. For example, does your buyer need to move quickly? Armed with this information, you are better positioned to bargain to your advantage.

18. WHAT THE BUYER CAN ACTUALLY AFFORD

As soon as possible, try to learn the amount of the mortgage the buyer is qualified to carry and how much his or her down payment is. If their offer is low, ask their Realtor about the buyer’s ability to pay what your home is worth.

19. WHEN THE BUYER WOULD LIKE TO CLOSE

Quite often, when the buyer would like to close is actually when they need to close. Knowledge of their deadlines for completing negotiations again creates a negotiating advantage for you.

20. DON’T BUY A NEW HOME BEFORE YOU SELL

Beware of closing on your new home while you are still making mortgage payments on the old one or you might end up becoming a seller who is eager (or even desperate) for the first deal that comes along.

21. DON’T MOVE OUT BEFORE YOU SELL

It’s been proven that it is more difficult to sell a home that is vacant because it becomes forlorn looking, forgotten, and no longer an appealing sight. Buyers start getting the message that you have another home and are probably motivated to sell. This could cost you thousands of dollars.

22. DEADLINES CREATE A SERIOUS DISADVANTAGE

Don’t try to sell by a certain date. This adds unnecessary pressure and is a serious disadvantage in the negotiation process.

23. DON’T TAKE LOW OFFERS PERSONALLY

Invariably the initial offer is below what both you and the buyer know the property will sell for. Don’t be upset…evaluate the offer objectively. Confirm that the offer details an offering price, sufficient deposit, amount of down payment, mortgage amount, a closing date, and any special requests. This simply provides a starting point from which to negotiate.

24. TURN THAT LOW OFFER AROUND

You can counter a low offer, or even an offer that is just below your asking price. This lets the buyer know that the first offer isn’t seen as a serious one. Now you’ll be negotiating only with serious buyers.

25. MAYBE THE BUYER ISN’T QUALIFIED

If you feel an offer is inadequate, now is the time to make sure the buyer is qualified to carry the size of mortgage the deal requires. Inquire how they arrived at their initial figure, and suggest they compare your price to the prices of homes for sale in your neighborhood.

26. ENSURE THE CONTRACT IS COMPLETE

To avoid problems, be sure that all the terms, costs, and responsibilities are spelled out in the contract of sale. It should include such items as the date it was made, names of parties involved, address of property being sold, purchase price, where deposit monies will be held, date for loan approval, date and place of closing, type of deed, including any contingencies that remain to be settled, and what personal property is included (or not) in the sale.

27. RESIST DEVIATING FROM THE CONTRACT

For example, if the buyer requests a move in prior to the closing, just say no; you’ve been advised against it. Now is not the time to take any chances of the deal falling through.

Are Discount Brokerages A Good Idea?

- You can speak to a lot of agents that work in a brokerage that you admire and that you want to get in to

- You can co-list with top producers if you have something in value and try to get into a team of a larger brokerage

- You can negotiate. Remember that commissions are always negotiable and you can frame negotiation talks more to your advantage

Making the Right Decision

Protect Your Art, Antiques and Collectibles

Know the condition of your belongings before movers handle them. Take detailed photos of your collection so that individual pieces can be clearly identified. If anything is missing after the move, the pictures will help you identify the specific pieces that must be found. For fine art and antiques, take photographs in bright lighting and from multiple angles. Don’t leave any room for guesswork should damage occur during transportation.

Moving companies are legally required to give basic coverage during transportation, but paying for full-value protection through your insurance agent is wise, especially for items that cannot be easily replaced. Insurance is another reason to take photos of your belongings — before and after images of mishandled valuables are powerful corroboration for reimbursement.

Experienced fine art movers will wear fresh, white gloves when touching paintings, sculptures or antiques. They should provide clean moving blankets and special packaging for custom or delicate items and have a system for labeling and identifying fragile boxes.

Certain antiques and art may deteriorate if exposed to extreme heat or cold for too long. Your movers should have climate-controlled moving trucks for your most sensitive belongings. Even if temperate conditions are not necessary, ensure that fragile belongings are the final pieces loaded into the moving vehicle, and the first pieces unloaded.

2018-QUARTERLY REPORT Statistics – Park City, Utah

Statistics – Park City, Utah

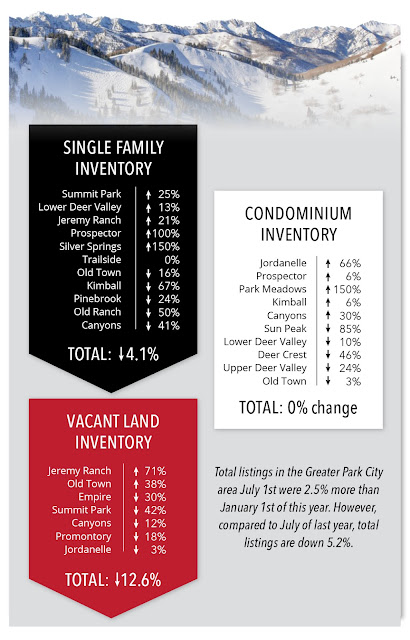

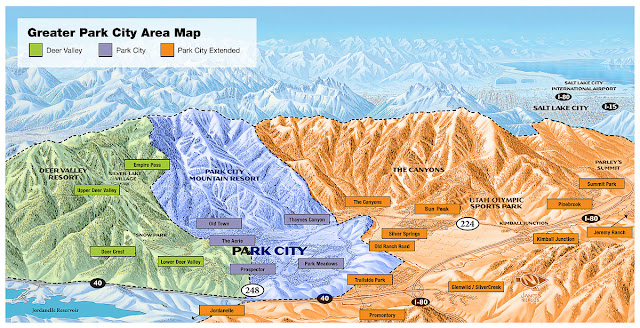

ENGEL & VÖLKERS PARK CITYPARK CITY, UTAH (August 8th, 2018) — Recent housing statistics for Summit and Wasatch Counties, as reported by the Park City Board of REALTORS®, revealed continued demand and increase in median sales price.

At the close of the second quarter of 2018, the number of single-family home sales in the Greater Park City Area increased by 6%, vacant land by 5%, while the condominium sector was slightly down compared to last year’s sales. Demand continued to rise on a gradual level, with single-family homes accounting for 49% of the total dollar volume, condominium sales for 40%, and vacant land for 11% of the market share. |

Snyderville Basin reported more than twice the number of home sales as the City Limits – a 4% increase over last year – with the median price climbing to $1.13 M – up 17%. In Silver Creek sales were up 40% and 37% in median sales price reaching $1.16 M. By neighborhood, Promontory had the highest number of sales in the Basin with 77 sold homes in the last 12 months. Activity in the Jordanelle area had a sizable increase in sales with a 14% median price increase reaching $1.73 M.

Sales in the Heber Valley continued at a strong pace, with nearly one sale a day, and a 28% median price increase to $506,000. There were 20 more homes sold in RedLedges compared to last year, with a median sales price of $1.16 M – up 8%. Midwaycontinued to thrive with 96 closed sales and 17% median price increase reaching $544,000.

“There are many factors contributing to the numbers we are seeing in the Heber Valley. Despite the sharp increase in construction costs, single-family homes are still well below Park City prices. With new amenities in the Heber Valley and excellent schools, buyers are weighing their options,” said Park City Board of REALTORS® President, Todd Anderson.

In the Kamas Valley, the number of sales decreased 15%, though the median price climbed 10% to $412,000. Sales numbers in the Wanship, Hoytsville, Coalville, Echo, & Henefer areas remained the same with a median price of $359,000.

Anderson explained, “The difference between these two areas may be attributed to the completion of developments in Empire Pass versus the reserved or pending status of the to-be-built product in Canyons Resort Village.” The Kimball Junction area, which can offer primary residence condominiums, saw flat sales but a 15% median price increase to $385,500.

The number of closed sales dropped 20% in the Jordanelle area possibly due to lack of inventory as new construction projects have been absorbed, but there was a 12% increase in median price reaching $528,000.

FREE HOME EVALUATION….$495 VALUE

–>

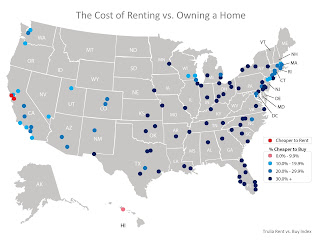

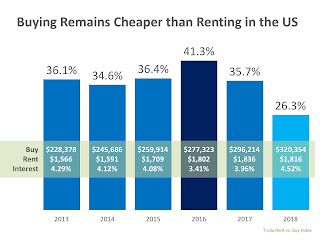

Buying Is Now 26.3% Cheaper Than Renting in the US!

“One point deserves emphasizing: The ultra-costly San Francisco Bay Area is not a harbinger for the nation as a whole. While renting may outweigh buying in San Jose and San Francisco, it is unlikely that renting will tip the scales nationally anytime soon.”

Bottom Line

FREE HOME EVALUATION….$495 VALUE

–>

A SURVIVAL GUIDE FOR MOVING WITH PETS

According to the vets at Pet MD, dogs generally tend to internalize their emotional pain, and stress reactions usually manifest in tummy troubles and/or a decrease in appetite. They may also become isolated and sleep more than usual.

To help relieve some of the stress associated with an impending move, Jodi Frediani, wrote in her article that the key to managing a dog in a stressful situation is balance and understanding. If you need to make changes that affect your pet, like doing doggie daycare to allow more home showing flexibility, you should try to ease them into the transition, by maybe doing a few hours a day until the dog can acclimate. At the same time, keep everything else as close to the same as possible, like feeding times, brand of food, and the amount of time you spend together.

Felines

Felines are nothing like dogs. If they ain’t happy, ain’t nobody happy. Cats have a harder time with stress and change than the average dog. Loud noise from workers preparing the home for market, strange people walking through the home and being confined to certain areas of the house are all stressors and could be the first sign of impending kitty apocalypse.

Pam Johnson-Bennett, a cat behaviorist, said that when getting ready to move with your feline family members, try to take household changes slowly. Repainting, new carpet installation, moving a litter box, and a busy open house all within the same week is just too much for most cats to process at once. Limit your changes to things that are absolutely necessary, and during this period do not change brands of food, litter, or the location of food, water, or litter boxes. Make sure kitty has a safe place to hide, and do not remove scratching posts or cat towers if your cat regularly uses them.

Pocket pets

One out of every 25 households has some form of “pocket pet,” the term used to classify small furry creatures like chinchillas, ferrets, sugar gliders, and rabbits. These little guys can also get stressed out from changes in their environment. When going through a move, sometimes our pets may get less attention due to the new demands on our time. Even though a pocket pet may not need to be walked, a lack of attention to cleaning their habitat or handling them can stress their immune systems. Daily handling can catch a small problem before it gets out of hand.

Moving can be stressful to our pets, but taking some of the above precautions will help everyone have a safe and comfortable move into your new home.

“Out-Of-State” Sellers Must Now Collect and Pay State Sales Taxes

The U.S. Supreme Court has overturned 26 years of precedent to rule that a state may compel out-of-state, or “remote,” sellers to collect sales tax from consumers who make purchases within the state. See South Dakota v. Wayfair, Inc., No. 17-494, 585 U.S. —, 2018 WL 3058015 (June 21, 2018). The Court ruled that a state may do so even where the seller does not have a “physical presence” in the state, such as employees or tangible assets. Although the decision by its terms applies to any “out-of-state” seller, the ruling is squarely aimed at online retailers, who previously reaped a competitive advantage at the expense of brick-and-mortar businesses by avoiding the costs of complying with state sales tax collection and payment laws, as well as a perceived price advantage over brick-and-mortar businesses.

Unless there is a provision in a tax treaty that exempts citizens of a contracting party from local taxation, sellers that are not based in the United States will also be subject to state sales tax collection and payment obligations on sales made into the United States.

Park City Summer Events You Shouldn’t Miss

In the last 90 days, Park City’s real estate market has grown increasingly complex. Buyers “tying properties up” with full-price offers, then cancelling for a myriad of unpredictable reasons. Sellers attempting to navigate the sales process solo. Agents using contract forms inaccurately. “Zestimates” setting unrealistic expectations. New construction projects with fluid completion timelines. A general sense of entitlement on all sides.

I, personally, did not see this coming and cannot explain the shift. What’s the takeaway? For agents: know your value proposition and be able to articulate it concisely. For buyers and sellers: allow your REALTOR® advocate to do their job for you; trust them and heed their advice. Lastly, forgive me, because while I wish I could control everything, I can’t. Just know that I am working tenaciously to get you to the closing table with your expectations exceeded every.single.time.

NOT YET ON THE MLS:

- 3BD/5BA/3074sf Old Town town home with rooftop deck; walkable to Main Street (~$1,650,000)

- 4BD/2BA/2095sf home with 1000sf unfinished basement on 200 East in Midway (~$470,000)

- 4BD/3BA/4659sf fixer-upper log home with apartment on 2.65 acres in Silver Creek ($950,000)

- 4BD/4BA/3616sf home built in 2010 with solar panels on a cul-de-sac in Prospector ($1,200,000)

- 6BD/6BA/6800sf home with entertainers deck on Lower Lando in Jeremy Ranch (~$1,695,000)

- 3BD/3BA/1571sf town home facing common area with a deep driveway at Park’s Edge ($439,000)

- 4BD/3BA/5713sf updated home with south-facing resort views in Park Meadows ($2,300,000)

- 4BD/4BA/4315sf downhill floor plan home with golf course views on Daybreaker in Jeremy Ranch ($1,350,000)

- 5BD/4BA/5180sf remodeled home on a flat 2.4-acre lot in Silver Creek ($1,225,000)

- 4BD/4BA/2900sf town home completed in Sept ’17 at Retreat at Jordanelle ($620,000)

FREE HOME EVALUATION….$495 VALUE

Big Stars Bright Nights “ST. REGIS”

This summer,the concerts will be located at Quinn’s Junction Sports Complex, Gillmor Way, in Park City with the exception of Grace Potter on July 13th, that will be held in City Park.

LOS LONELY BOYS

July 3, 2018

GRACE POTTER

July 13, 2018

CHRIS BLUE

July 23, 2018

LUCIA MICARELLI

and JOSHUA ROMAN

August 5, 2018

CORINNE BAILEY RAE

August 10, 2018

DON FELDER

formerly of the Eagles

August 11, 2018

BRUCE HORNSBY

and The Noisemakers

August 16, 2018

THE WALLFLOWERS

August 24, 2018

NASHVILLE CAFÉ

CHRIS CARMACK • CHIP ESTEN

September 2, 2018

Kings Crown Park City, new development at the Base of Park City Mountain

FREE HOME EVALUATION….$495 VALUE

–>

Market Expert

Credit Myths and Misconceptions

Don’t let incorrect information influence your

credit behavior.

The spring market is in full swing

The Higman are ready to work on fast pre-approvals, answer any questions, thoughtfully consider all options and communicate every step of the way to the closing table.

Do you have any friends or family in need of real estate to buy or sell their home? If so most of my business comes from referrals. I would be grateful for a referral from you.

In today’s competitive buyer’s market, standing out from the crowd with a home offer letter may be the difference when it comes to my customers purchasing the home of their dreams. While the best possible offer for the home is crucial, writing a personal letter to accompany that offer is an excellent idea. shot me an email or give me a call and I will be happy to give you some great tips about writing a personal letter to accompany your home offer.

My team is ready to help you become homeowners today. Text or call me at (435) 602.8228 with your referrals, and I will call them promptly! Have a fantastic June!

Thank you

Paula Higman- Lead agent

Engel & Völkers

FREE HOME EVALUATION…$495 VALUE

FREE HOME EVALUATION…$495 VALUE

How to Build a Home Renovation Team You Can Trust in Park City, Utah

Create a list of candidates

Call your best candidates

Set up in-person interviews

Carefully select your general contractor

Be present, but don’t micromanage

The Snow went away fast so refresh your home’s exterior this spring with a new paint job.

1-day project: Wash your house

- A pressure washer is the most popular cleaning tool, thanks to its powerful spray — but it’s not a magic wand. In addition to patience, you’ll also need protective eyewear, a couple of five-gallon buckets, a pressure-washing cleaning solution and a stiff brush.

- Soak the surface first to loosen up debris, and then start cleaning with a wide, sweeping motion, from the bottom to the top of each wall.

- To prevent damage, start spraying at a distance of 10 feet and work your way in. Wash windows, garage doors and cracked seals at the lowest setting or by hand.

- If that big, loud pressure washer leaves you feeling a little gun-shy, you can get the same results with a scrub brush, bleach solution and garden hose.

Weekend project: Make repairs

- Using a sanding block and razor blade, remove any protruding burrs or paint drips. To speed up the job, use a rotary tool or power sander.

- Patch and fill holes with the filler that’s appropriate for your siding. For example, you can use wood filler on wood, but fiber cement siding (sometimes known as Hardie Board) requires cement patch. Sand when dry.

- Replace old caulk with either a small putty knife or painter’s tool. Apply the caulk slowly for a smooth bead, using a damp rag to wipe up the excess. Practice in an inconspicuous area if needed.

- Replace any rotted trim or siding immediately. This will definitely add some time and cost to your project, but it sure beats painting over rotted wood and a colony of termites.

- Spend Sunday applying primer, following the manufacturer’s instructions. Even if you plan on painting with a two-in-one paint that includes primer, old paint jobs and stained areas will still need a layer of primer to help paint adhere. If you run out of prime-time this weekend, finish when you kick off the next project next weekend.

- In the meantime, do some planning. Decide on a paint palette with two or three colors (base, trim and accent) and get ready for the fun part.

Month-long project: Paint!

Week 1: Upgrade the front door casing

- Once you’ve found the perfect style, take measurements and plan out the placement on paper before purchasing and cutting the lumber.

- If feasible, purchase rot-resistant PVC trim. Pressure-treated wood is cheaper but must be preserved, dried and primed before installation.

- To remove the old casing, cut through the caulk with a utility knife and carefully remove casing with a pry bar.

- Cut the new casing to size, letting it sit flush against the bottom.

Week 2: Paint the siding

- This can be done in the afternoon or evening, so tackle the job in sections. Shake and stir the paint before you begin for even coverage.

- Cover any light fixtures, doorbells, and windows where you intend to paint, and use an angled brush to paint along edges without making a mess. Use a roller to fill in the broad areas, working from top to bottom. Paint the trim last, wiping up any stray spatters with a damp rag.

Week 3: Apply a second coat

- Sand out any paint drips or debris.

- Paint the siding and trim another coat.

Week 4: Tackle the details

- Paint the front door the color of your dreams.

- Add shutters, if you like.

- Upgrade and add extras: new crown molding for the porch, a doorbell, a new house number, door handles, and light fixtures.

Park City Renters: Are You Ready to Buy a Home and Stop Seeing Rent Go Through The Roof?

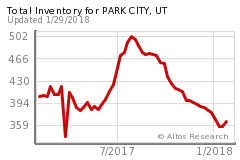

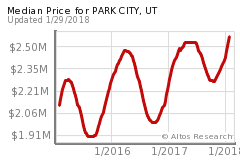

***One statistic that is consistent in every neighborhood is a decrease in inventory and a decrease in the average days on market. Overall, inventory is down 22% and average days on market is down 7%.

***The median single family home sale price rose 4% from 2016 to 2017. This includes our entire MLS market (everything from Summit Park to Deer Valley and the Heber Valley). However, in Park City’s 84060, the median sale price rose 16%. In Park City’s 84098, the increase was only 3%.

***Jeremy Ranch had 66 single family home sales in 2017, an increase of 27% from 2016. Pinebrook had 44 sales, which as flat from 2016. In contrast, Silver Springs only had 29 sales and Prospector only had 13 sales.

***In contrast to the median single family sale prices in Park City’s zip codes, the 2017 median sale price was $410,000 in Heber/Daniels and $529,000 in Midway.

***Deer Valley does not suffer from the same inventory issues as other locations. Over the last 24 months, single family home inventory increased by 18.5% and the number of homes sold during that same period decreased by 36.7%.

Park City is notorious for homes needing Love: Are There Signs in your home telling you It’s Time to Update Your Bathroom

1. Not photogenic

2. Outdated colors

3. Smells like a bathroom

4. Bad layout

5. Leaks

6. Poor lighting

7. Stylistic relics

8. Low on storage

9. Time to sell

If you’re not interested in fixing up your bathroom for yourself, do it for your home’s next tenants.

The fix: A fancy new washroom can add just the right panache to spur potential buyers to action. “Redoing a bathroom that’s just an eyesore within the house might make a huge difference,”

We live in the mountains, but when the rock climbing is right at your doorstep it’s easier to watch your kids.

The home also contains a dining space with bench-style seating that doubles as storage.

“Ideas have spread from it quite a bit, but no one else has bought the exact same thing,” Francis said. “We have had a client request a rock wall system in the house as a way up to the lofts for his two young boys.”

What NOT to Do in Park City, UT. When Remodeling Bathrooms

Mistake 1: Ignoring proper spacing and layout

Mistake 2: Choosing the wrong materials

Mistake 3: Ignoring storage space

Mistake 4: Forgetting about ventilation

Mistake 5: Putting off lighting plans until the end

3 Simple Social Media

1. Leverage the power of ad platforms:

- Step 1: Identify what your brand pillars or values are. What do you stand for? What are the core topics that you regularly speak about? Once you’ve identified those central touchpoints, create a Google Sheet and write those touchpoints at the top to create columns.

- Step 2: Without overthinking it, write down content ideas which fall into each category. A great way to think of new ideas is by thinking of questions that previous clients have asked you, using tools like BuzzSumo, or scrolling an industry-relevant publication. For example, if you’re a consultant for emerging authors, under the ‘Writing Process’ column, maybe you would write in “5 Tips For Overcoming Writer’s Block” and “How To Come Up WIth A Killer Opening Chapter Title”. Essentially, the point of this step is to build up a ton of ideas, so that when it comes time to sit down and create content, you don’t get away with the excuse of feeling “uninspired” or “just not creative” that day. You have tons of killer, on-brand content ideas ready to go, so put them into your content calendar.

- Step 3: Now it’s time to build your content calendar. This can be as easy as opening up another Google Sheet and building out your column titles: ‘Day’, ‘Date’, ‘Content category’, ‘Title of content’, etc. All you have to do is now take the content ideas that you had in your previous Google Sheet and start building it out, going pillar by pillar. This will enable you to ensure that you’re hitting every single brand value consistently, sharing high-value and high-impact information on a regular basis, and that each piece of content has a clear goal. No randomness, no fluff, no off-brand anything. How easy was that? You can now build out your calendar two weeks in advance, have consistent content to share with your growing audience, and convert those followers into clients in a fraction of the time.

3. Consider outsourcing social media tasks:

Facebook has released a new set of monetization options and best practices for video creators

Monetization Options

- Pre-Roll ads – Facebook says it’s seen “promising signs” from their initial tests of pre-roll ads, which they’re now expanding to additional areas, including in search results and on Page timelines. “For example, if a person searches for a show, a pre-roll may play when they select the episode to watch”.

- Preview Trailers – Facebook’s also testing a new preview trailer format for Watch shows that will improve discovery in News Feed. “When a viewer taps on the trailer, we’ll play a short ad before moving them to view the full episode in Watch. Partners will also be able to boost this format, reaching new audiences and driving more predictable tune-in while still being able to monetize”. Preview trailers will only be available to approved Watch shows.

- Ad Breaks Auto Insertion – Facebook’s also working to advance its recently announced auto ad breaks tool, which automatically detects the ideal place for an ad break within an eligible video. The option could make it easier for creators to understand when and where ad breaks fit best within their content.

- Pre-Publish Brand Safety Check – Finally, Facebook’s rolling out a new option which will enable content partners to submit videos for monetization eligibility review before posting, which will help to ensure their video will receive relevant ad opportunities.

Video Best Practices:

- Build audiences on Facebook surfaces where people seek out content – Encourage audience engagement outside of News Feed on surfaces that support repeat, loyal viewership such as in Watch, on a Page or in a Group. These places allow for audiences to meaningfully interact with each other to build community around your content.

- Set and fulfill the creative expectations of viewers – A consistent voice and format drives repeat viewing and longer view times. Some successful formats that foster communities of fans around content include serialized shows or videos with a predictable cast and format.

- Establish a release cadence – A set publishing schedule encourages audiences to consistently return to watch the next episode. Posting related videos, photos, or text posts helps to keep your fans engaged between episodes and seasons.

- Create an active experience – Sourcing topics from audiences and engaging with commenters draws the audience closer to the content.

- In other words, the best way to build an audience is to adopt a regular TV-show type model, using consistent characters/cast and publishing at the same time every week/month.

Social Media 101 – Social Media Quick start

FREE HOME EVALUATION…$495 VALUE

Marketing strategies you may not have tried yet

If the old tactics to market your business aren’t working. It’s time you try some new strategies.

1. Offer an award for referrals

——

Do you understand Loan-to-Value Ratio on a Mortgage….

Formulation:

Loan Amount ÷ Lessor of Appraised Value or Selling Price = Loan-to-Value Ration

Example:

Good Rule of Thumb:

FREE HOME EVALUATION…$495 VALUE

10 things you’re missing out on by using a personal email account to do your email marketing

If you’re like a lot of small businesses and organizations, you may be using a personal email account…like Gmail…to communicate with a group of email contacts.

- Problems getting messages delivered: Has anyone ever told you they didn’t receive your email? Sending mass emails from a personal account can result in more emails being sent to the spam folder.

- Difficulty keeping track of your email contacts: Manually keeping track of new email addresses and people who have asked to be taken off your list can cause headaches and take up hours of your time.

- No understanding of who opened an email or clicked a link: You hope your emails are getting opened and read, but personal accounts don’t provide that information.

–

Selling a Home After The Death of a Parent

Getting a house ready to sell after a loved one dies

Did the seller die in the house?

First, know that if the seller died in the house, you may be required to disclose this fact to a prospective buyer. Ask a real estate agent about seller disclosures for your state and whether a death in the home is considered a material fact. In California, for example, only deaths over the past 3 years require disclosure.

Change the Locks and Forward Mail

- Homeowner’s policy. Keep the homeowner’s policy effective until the day the home closes. Increase coverage if it is too low.

- Will. Look for updated Wills and copies.

- Insurance. This could be a private policy or purchased through an employer.

- Bank accounts. Carefully read the statements as many banks report all accounts on one statement.

- Letters from the homeowner’s friends. You may want to write to them.

- Poems, articles, letters from the deceased. These will later bring you comfort.

- Bill receipts. Contact creditors. Consider notifying all three credit reporting agencies to freeze new charges.

- Stocks and bonds. They might be tucked into folders.

- Shred all sensitive documents, especially those containing a Social Security number.

Sort personal belongings

- Items to keep

- Items to donate or sell

- Items to throw away

Prepare House for Sale

- Furniture. If the furniture is old or worn, get rid of it. Don’t leave it in the house because it will detract from the sale.

- Wall hangings. Remove them.

- Floor covering. Consider its condition. If there is carpeting over wood floors, expose the wood floors and, if necessary, refinish the floors. Replace cracked ceramic tiles. Clean carpet over plywood or buy new carpeting.

- Window coverings. If the window coverings are dated, throw them out. Most windows look better without heavy drapes or worn blinds.

- Walls. Some people paint once and never again. You may need to patch and repaint the walls.

- Ceilings. Replace dated light fixtures, patch cracks in the ceiling and paint.

- Remove all pet-related items. Take the outdoor dog house with you and donate it to a shelter. Selling with signs of pets in the home is a turnoff for many buyers.

- Clean from top to bottom. Wash windows, dust ceiling fan blades and wipe down the insides of cabinets.

Repairs and Upgrades: How Much Will They Cost?

–

Avalanche triggered by snowboarders on Park City ridgeline – Friday, February 16th 2018

How To Buy A Home At Auction: What You Need To Know

Park City Board of REALTORS® Releases Annual Statistics

- Old Town sales increased 30%.

- Park Meadows median sale price increased 13%.

- Prospector sales increased 30% and median sale price increased 6%.

- The Canyons area had sales increase 13%.

- Silver Springs median sale price increased 6%.

- Pinebrook median sale price increased 7%.

- Jeremy Ranch sales increased 25% with a 5% increase in median sale price.

- Promontory sales increased 20%.

- Heber Valley median sale price increased 15%.

- Jordanelle sales increased 66%.

- Kamas Valley sales increased 4%.

- Oakley and Weber Canyon sales increased 14%.

- Old Town sales increased 19%.

- Lower Deer Valley sales increased 18%.

- Kimball sales increased 3% with a median sale price increase of 33%.

- Pinebrook median sale price increased 10%.

Greater Park City Quarterly Market Update

A Market Update Report comparing Current Year vs. Previous Years

Deer Valley & Park City Limits

Snyderville Basin Real Estate Sales Statistics

Want Customized Reports for Your Neighborhood?

Getting Your Park City and Deer Valley Home Ready To Sell

Getting Your Home Ready to Sell

Why Use a Park City Real Estate Agent?

Preparing Your House

Enlist Our Pros

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link